A public holiday may be coming up and while paying your team members more is great, you may like to apply a small surcharge to clients to help offset that cost. Client Diary has a wide array of functions to assist in making streamline transactions. One in particular is the Surcharge tool. This allows you to create surcharges that you can then apply to the client’s bill. These can be manually applied or automatically applied.

To Create a New Surcharge

- Head to Point of Sale

- Select to Add Item

- Click on Misc.

- Press the (+) button next to Surcharge

- This will bring up the Create Surcharge window

The following options are available:

- Surcharge Name: What this surcharge will be called

- Value: The value to be applied to surcharge

- Percentage: What percentage to set the surcharge at

- Both: Sets both a Money Value and Percentage value to the surcharge

- Always apply this surcharge for future transactions: Will automatically apply this surcharge to all future transactions in POS.

Once you are happy with the settings you have applied to the surcharge click the Create button to finalise the created surcharge.

Below is an example using the $ Value only

Below is an example using the % Percentage only

Below is an example using BOTH $ and %

How To Apply A Surcharge To an Existing Appointment

- When in Calendar, Select the Appointment

- Click on +Add Item

- Choose the Misc. Tab

- Press the down drop button next to Surcharge

- Click on the surcharge

When you have selected always apply this surcharge for future transactions, the surcharge will apply automatically to all transactions you have in your POS area.

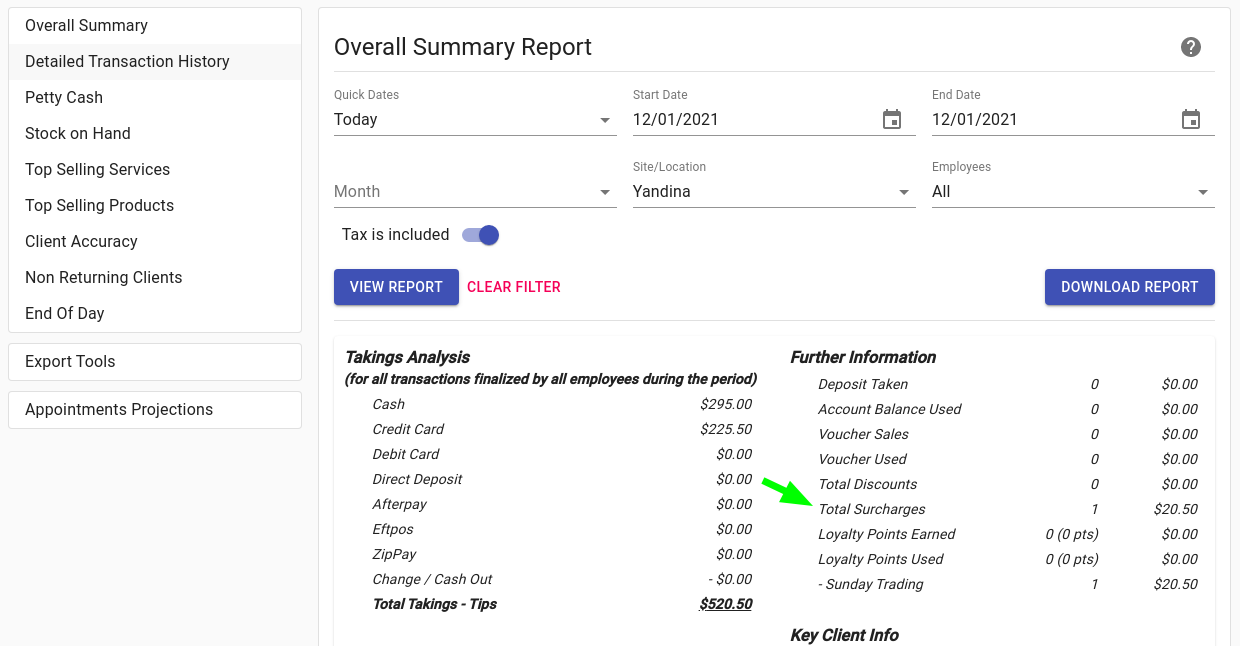

How To View Surcharges In Your Reports

You can see the surcharges figures in your Overview Summary report under the heading Further Information. Total Surcharges will the total amount of all surcharges for the selected time period. Click here for further information on the Overview summary report.

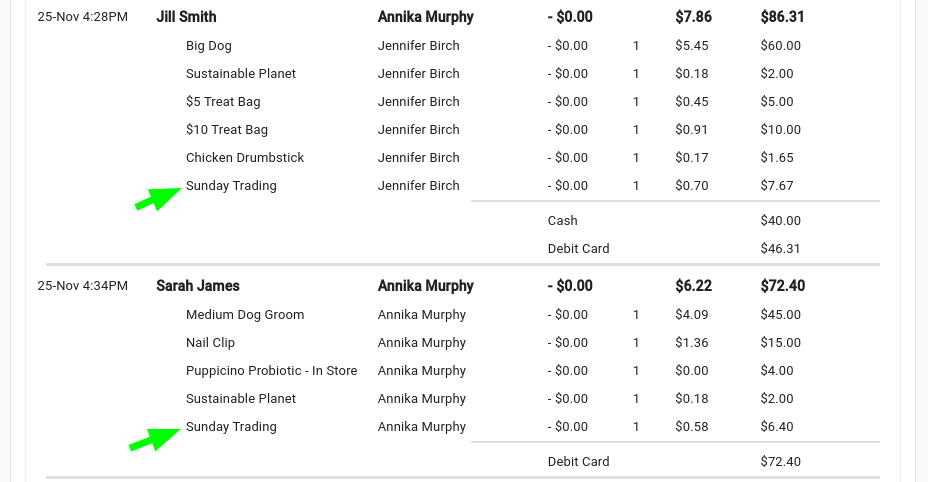

You can also view the surcharge on individual transactions in the Detailed Transaction History report. Click here for further information on the Detailed Transaction Report.