This document is for information on ensuring your Xero is setup so it connects easily and properly to Client Diary. This is not the documentation on how to apply the actual link from Client Diary to Xero. For that information please follow this link. How To Apply Xero To Client Diary Please note this is a general guide and your book keeper / accountant should be consulted to help you setup Xero properly.

For Client Diary to link to Xero you will need three accounts setup in Xero:

- A Sales Account or a Revenue Account

- An Asset Account or a Bank Account

- A Current Liability Account to record Gift Voucher sales and usage.

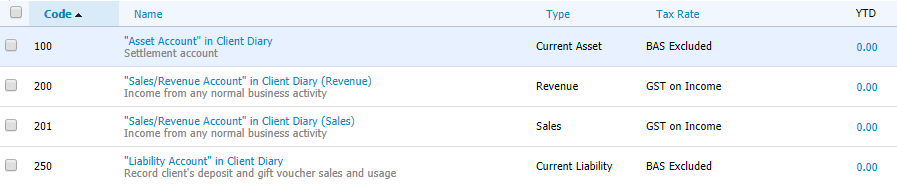

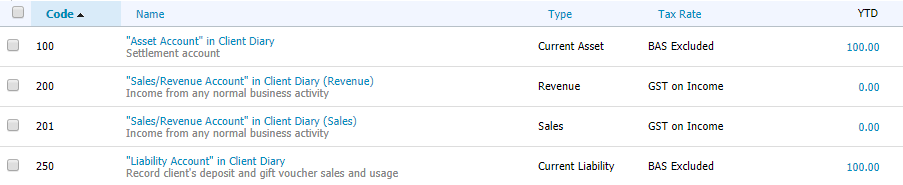

Here is an example of our three accounts setup in Xero:

Note: You can use either example 200 or 201 above, not both. In Xero, you will either have a Sales Account or a Revenue Account linked to your Asset Account in Client Diary.

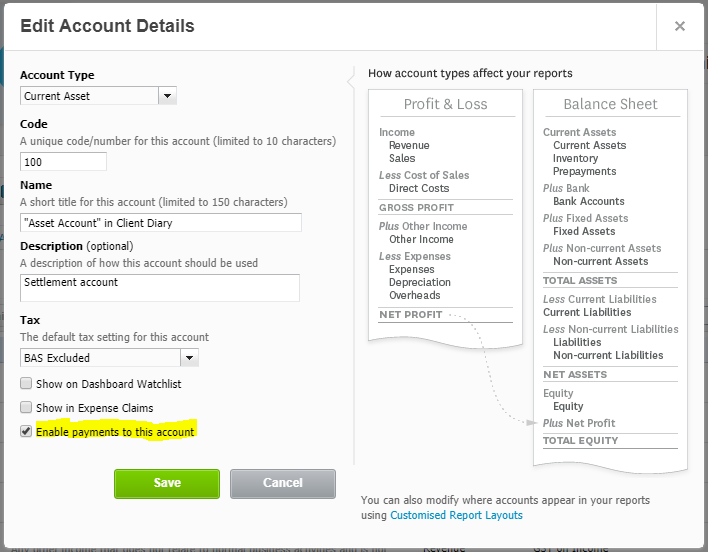

To have the Sales and Revenue accept the figures from Client Diary you must enable payments for those account types as shown in the image below.

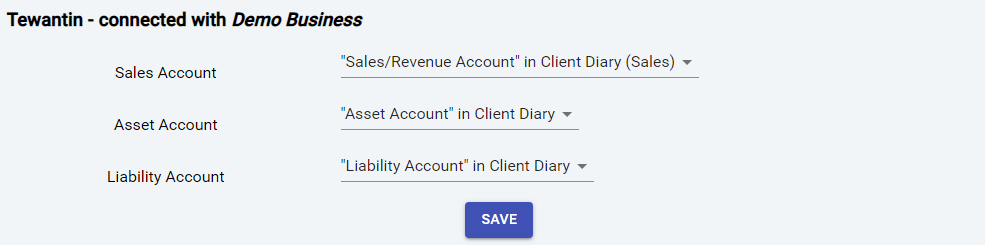

When linking to Client Diary, they would link similarly to this example:

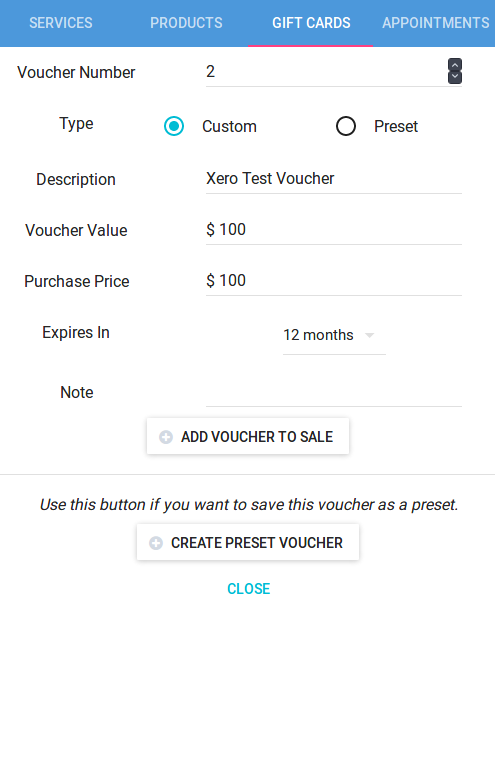

Example using Gift Voucher

To see Client Diary interacting with Xero, let’s look at how this will work with a Gift Voucher sale and redemption.

Let’s imagine we sell a Gift Voucher today. It’s for $100.

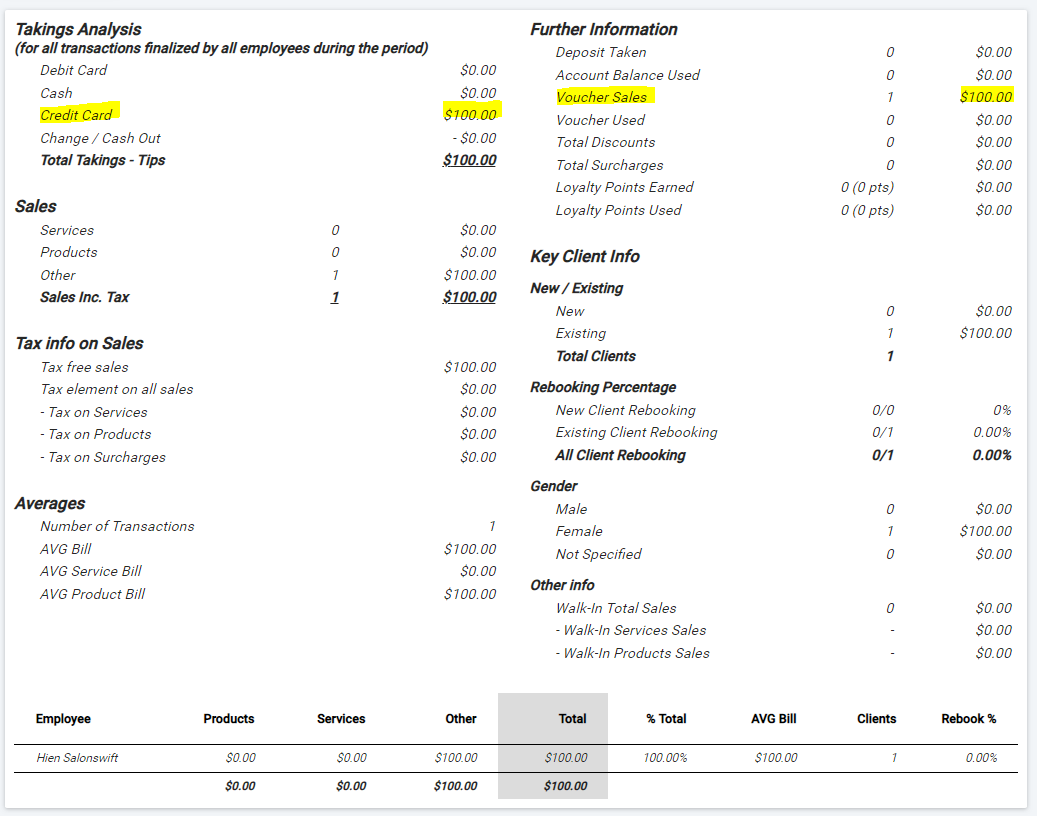

After processing the sale, the report below shows the Gift Voucher sale has been processed.

- After the day has finished. We perform an END of DAY to send the data to Xero.

The below image shows the data in Xero after the End of Day is complete.

The following day a client comes in and redeems the voucher we sold.

- Let’s imagine they have $150 worth of services.

- They use the $100 voucher

- They also use $50 cash

- After the day has finished. We perform an END of DAY to send the data to Xero.

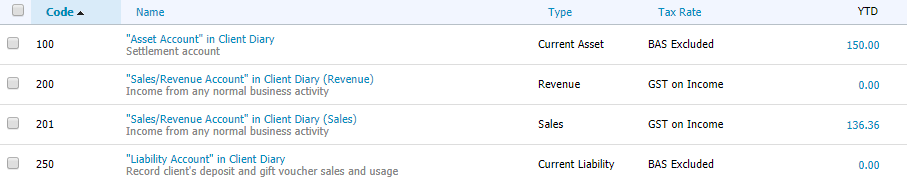

The below image shows the data in Xero after the End of Day is complete.

Note: The Vouchers / Liability account is now showing $0. This is because the voucher has been redeemed and applied to the account making it balance.

Note: The Bank Account shows $136 which is the $150 minus tax .

Note: Above the $136.36 has gone to the Sales account type. This could have gone to the Revenue account type if you set yours up that way instead.

This small example should help you and your accountant / book keeper understand the integration and setup. If you need further help, just let us know.