Client Diary allows you to view your reporting figures including or excluding tax, depending on your requirements.

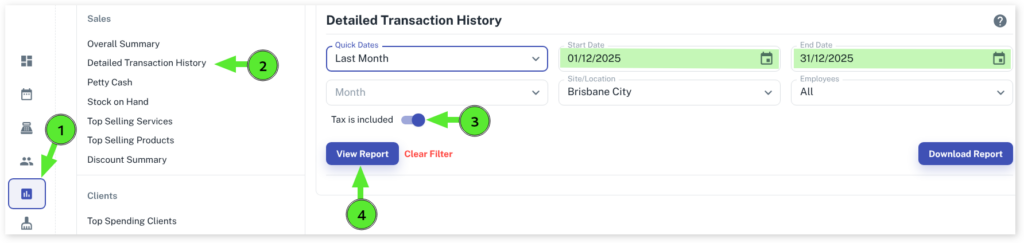

To do this go to:

- The Reports menu

- Select the Report you wish to view

- Choose your options to view your report as normal (date, staff, location etc.)

- Select the Tax Is Excluded/Tax Is Included slider to toggle the tax option

- Press the View Report button

NOTE: To learn about reports further, please click here to read more

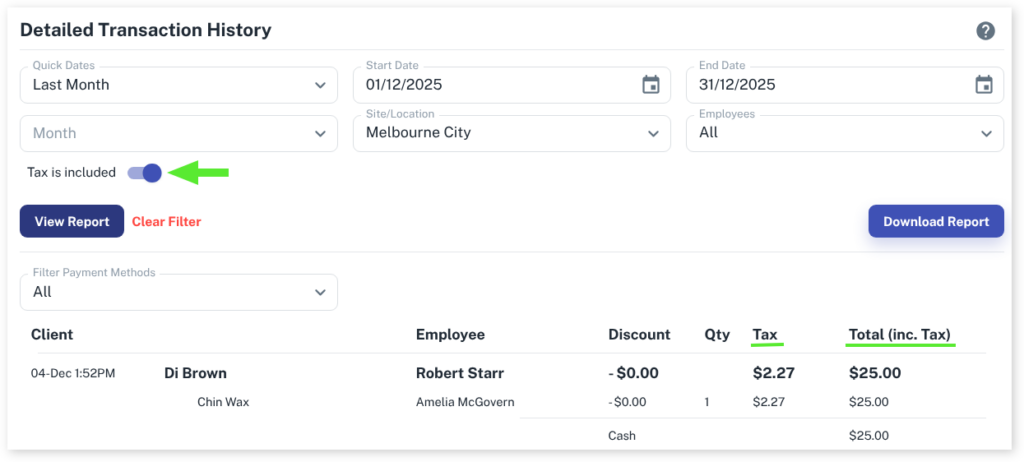

Tax Included In The Report

Above is an examples of what a report looks like when the Tax is included option is selected.

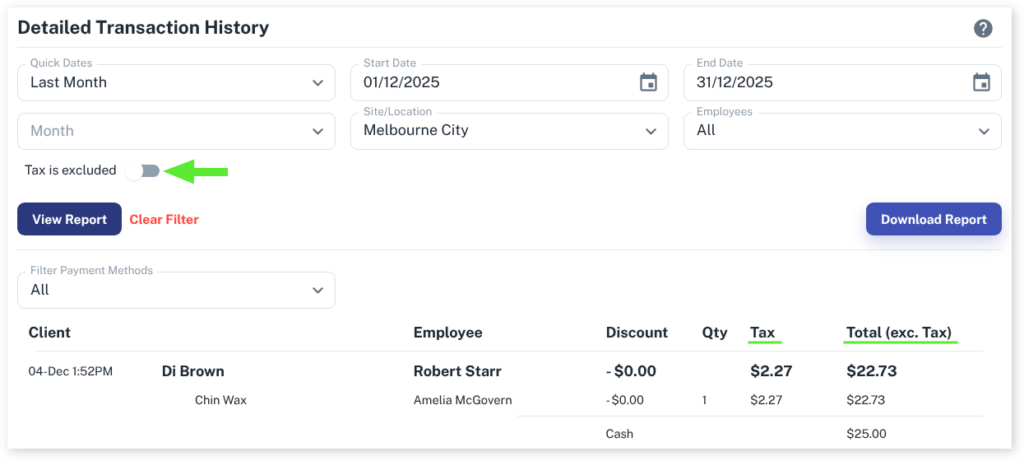

Tax Excluded From Report

Above is an examples of what a report looks like when the Tax is excluded option is selected.

Note: When you enable or disable tax options on your reports it also applies those same options automatically to your staff targets as well.

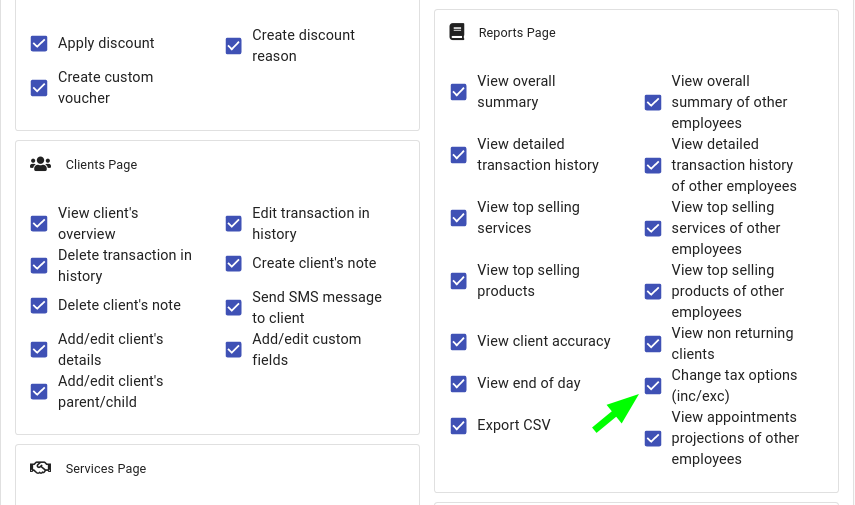

How to Restrict Employees from Changing the Tax Option

In the Employee Security Groups you can restrict an employee’s ability to change the tax option. If you haven’t done this already:

- Click Here to learn how to setup Employee Security Groups if you haven’t set it up already in Client Diary.

Once that’s done, go to:

- My Account menu

- Select the Security tab on the top menu bar

- Select Employee Security Groups

- Select which employee group the employee in question has been assigned to

- In the Reports Page section tick or untick Change Tax Options (inc/exc)

- Click on Save button to apply changes.