Xero is world-leading online accounting software built for small business. Integrating Xero with Client Diary will help you sync your daily sales figures from Client Diary to Xero for easier and better reconcilliation.

What does this integration do?

When you connect Xero to your Client Diary account, we will automatically create invoice in Xero and send your total sales, deposits and vouchers figures of the day when you finish your End of Day. Those figures will be ready in Xero, waiting for you to reconcile with your bank account records. Better bookeeping, better business.

Assuming you already connected Xero to Client Diary. Here is how the data is sent to Xero after you complete the End of Day process.

- Client Diary automatically seperates your figures to 2 categories: Sales and Liabilities (if applicable).

- “Sales” figures will also seperate to 2 items in the invoice: sales that attract tax (e.g. GST) and sales that are tax free

- “Liabilities” figures will be seperated to 2 items in the invoice: Voucher Sales and Customer Deposit

- Client Diary creates an invoice in Xero with all these figures.

- (Optional) Client Diary groups payments you received into different payment methods and automatically applies to the invoice created above. The invoice will be marked as paid. If you don’t want Client Diary to send payments to Xero, you can turn this off in settings page.

- When the money is cleared in your bank account, you can start reconcile by matching the bank transactions with the payments from Client Diary.

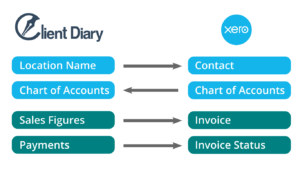

Data Flow Diagram

Getting Started

Setting up is easy, we have composed a detailed guide – How to Apply Xero to Client Diary. As we are certified as Xero Connected App, you only need to connect once and the connection will last until you decide to disconnect Xero and Client Diary.

If you need an example, don’t forget to check out Xero setup – basic guidelines and example.

FAQ

How is tax calculated in Client Diary and Xero?

You can set tax rate in Client Diary in My Account -> Settings. You can then apply this rate to applicable services and products in Services page and Products page. When sending end of day figures to Xero, Client Diary will seperate taxable and non-taxable items to different lines in the invoice. For taxble items, the tax amount will be calculated by Xero using the Xero’s tax rate. To make sure your Xero’s tax rate is correct, please follow Xero tax rate guide here.

What is liability account and why do I need it when connecting to Xero?

Liability account is a payable account that shows how much it owes. In simple term, money in liability account is money that you may already received but you are still liable for it and it is not considered as income. For example, gift vouchers and customer deposits are liable payments.

When you sell a gift voucher or take a deposit, you take the payment upfront for a service/product that you promise to give your customer at a later date. After the voucher/deposit is used and the service/product is fulfilled, the liable payment will be transferred from liability account to sales account and therefore, becomes your income.

Client Diary needs you to select Liability Account when connecting to Xero in order to keep track with voucher sales and deposits as well as when vouchers/deposits are used as the above scenario correctly to help you make sure your business is tax compliance.

I don’t want Client Diary sends invoice to Xero as paid because the money is not in my bank yet. How do I turn it off?

By default, after completing End of Day process, Client Diary sends sales figures as well as payments you received to Xero. However, we understand in some cases, this behavious is undesired.

Therefore, we have added an option to send invoice to Xero as unpaid. You can find this option in My Account -> Add-Ons -> Xero where you initially connect Xero to Client Diary. Simply check the box to turn on this option and Client Diary will not send payments to Xero.

How do I disconnect from Xero?

If you no longer want Client Diary sending figures to Xero, you can find the Disconnect from Xero button in My Account -> Add-Ons -> Xero.

My business is New Zealand based, is my tax type supported?

Yes, with added support for New Zealand tax types, you can connect Client Diary with Xero and have them share the needed information.

Can’t find your questions above?

Feel free to email us at support@clientdiary.com